Essential Tips for Making Safe Deposits -1463371326

Essential Tips for Making Safe Deposits

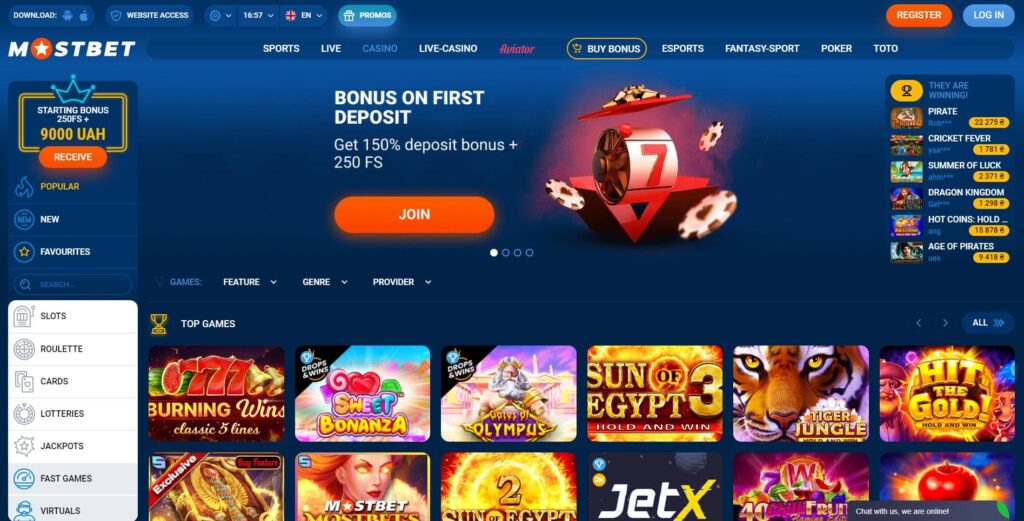

In today’s digital age, where online transactions have become ubiquitous, ensuring the safety of your deposits is critical. Whether you’re depositing money into a bank account, an online wallet, or a gaming platform, following the right precautions can help mitigate the risks of fraud and theft. In this guide, we will explore various strategies to make safe deposits, including the importance of using reputable platforms, implementing strong security measures, and being vigilant against potential scams. If you are considering an online gaming experience, check out How to Make Safe Deposits and Withdrawals at Sportsbooks in Bangladesh Mostbet online for a secure and enjoyable environment.

Understanding the Importance of Security

The importance of security cannot be overstated when it comes to making deposits. Whether you are moving your funds into a savings account or funding an online gaming account, the risk of cyber threats is ever-present. Understanding the different layers of security that various platforms offer can help you make informed choices. Additionally, it’s crucial to be aware of your own habits, ensuring that you employ safe practices when managing your finances.

Choosing Reputable Platforms

One of the first steps in ensuring the safety of your deposits is to select a reputable platform. Whether it’s a bank, an online payment service, or a gambling site, always do your research. Look for:

- Licensing and Regulation: Ensure that the platform is licensed and regulated by a recognized authority. This means they adhere to strict security protocols to protect users’ funds.

- User Reviews and Ratings: Consider the experiences of other users. Check online reviews and ratings to gauge the reliability of the platform.

- Established Reputation: Platforms that have been in the industry for several years are usually more trustworthy. They have a track record you can evaluate.

Using Strong Passwords and 2FA

Your accounts are only as secure as your passwords. Using a strong password is the first line of defense against unauthorized access. Here are some tips for creating strong passwords:

- Use a mix of uppercase letters, lowercase letters, numbers, and special characters.

- Make your password at least 12 characters long.

- Avoid using easily guessable information such as birthdays or names.

In addition to strong passwords, enabling two-factor authentication (2FA) provides an extra layer of protection. 2FA requires you to provide a second form of verification, such as a code sent to your phone, making it much harder for someone to gain unauthorized access to your account.

Monitoring Your Accounts

Regularly monitoring your accounts can help you catch any suspicious activity early. Set reminders to check your transaction history, bank statements, and any deposits you’ve made. Here are some key practices:

- Use mobile banking apps for real-time notifications of transactions.

- Review your bank statements weekly to identify any unauthorized charges.

- Set up alerts for any withdrawals or deposits to your accounts.

Being proactive can save you from potential losses and provide peace of mind.

Beware of Phishing Scams

Phishing scams remain a prevalent threat in the digital world. These scams often impersonate legitimate businesses to trick you into providing personal information or making unauthorized deposits. To avoid falling victim to phishing:

- Be cautious of unsolicited emails or texts asking for your personal information.

- Look for signs of scam emails, such as poor grammar or spelling errors.

- Verify the sender’s address and avoid clicking on links unless you are certain they are safe.

Always go directly to the website of the institution you are dealing with instead of clicking on links in emails.

Using Secure Connections

When making deposits online, always ensure that you are using a secure connection. Look for the following:

- Https://: Check for “https://” in the website’s URL. The “s” indicates a secure connection.

- Secure Wi-Fi: Avoid making financial transactions over public Wi-Fi networks. Use a private network for better security.

Using a Virtual Private Network (VPN) is also advisable as it encrypts your internet connection and protects your data from prying eyes.

Consider Insurance Options

For larger deposits, it may be wise to consider insurance options. This could include ensuring that your bank deposits are covered by federal insurance (like the FDIC in the United States) or considering safeguard features available on certain platforms. Additionally, for deposits in investment accounts, various financial products may offer protection against losses, which can provide peace of mind.

Conclusion

Making safe deposits is crucial in protecting your financial well-being in an increasingly digital world. By choosing reputable platforms, implementing strong security measures, and staying vigilant about potential threats, you can significantly reduce your risk of fraud. Remember, your diligence and caution play vital roles in safeguarding your deposits. Following the tips outlined in this article will equip you with the knowledge and tools you need to navigate the online transaction landscape safely and effectively.